بسم الله الرحمان الرحيم

Winning stratgies

فكرة خطرت على بالي و ارى ان فيها افادة ان شاء الله لكل المتداولين المهتمين بالتعلم و المحبين لامتلاك سلح التعلم و هو الوسيلة الوحيدة للنجاح..

و رغبتي في المزيد من التعلم احببت ان ارفق في كل مرة مقتطفات من كتاب مفيد باللغة الانجليزية من البداية حتى النهاية للمتداول المبتدأ و المحترف..

بين كل فقرة سيكون هناك وقت مستقطع للفهم و تثبيت المعلومة..ولمن يريد التعلم و يناقش فهده هي الفرصة..

الباب مفتوح لمن اراد ترجمة كل فقرة يتم ارفاقها شرط ان تكون الترجمة دات جودة عالية..

فمرحبا بكم معنا هنا في هده الجولة التعليمية

.gif)

البداية

Getting Started

It is the biggest and fastest growing financial market in the world, with an average

daily turnover of almost $2 trillion – many times the total traded volume of the US

.stock exchanges

currencies, with trading all done over-the-counter (OTC), which means that there

is no central exchange and clearinghouse where orders are matched. If you are

looking for 24-hour action, you can find it in this global trading system, where no

physical barriers exist and activity moves seamlessly from one major financial

.centre to another

,exclusive playground of banks, hedge funds, corporations and financial institutions

,where money changed hands for commercial and speculative purposes. However

forex has now expanded and is easily accessible to all traders with the rapid

emergence of online currency trading platforms. Many of these platforms are wellequipped

with free charting software, real-time news-feeds and easy-to-use order

placing systems

of foreign exchange, where self-directed (so-called “retail”) traders can easily buy

,and sell currencies through an internet connection with a click of the mouse

dealing with invisible counter-parties on the other side of the transaction. This

group of people (also known as

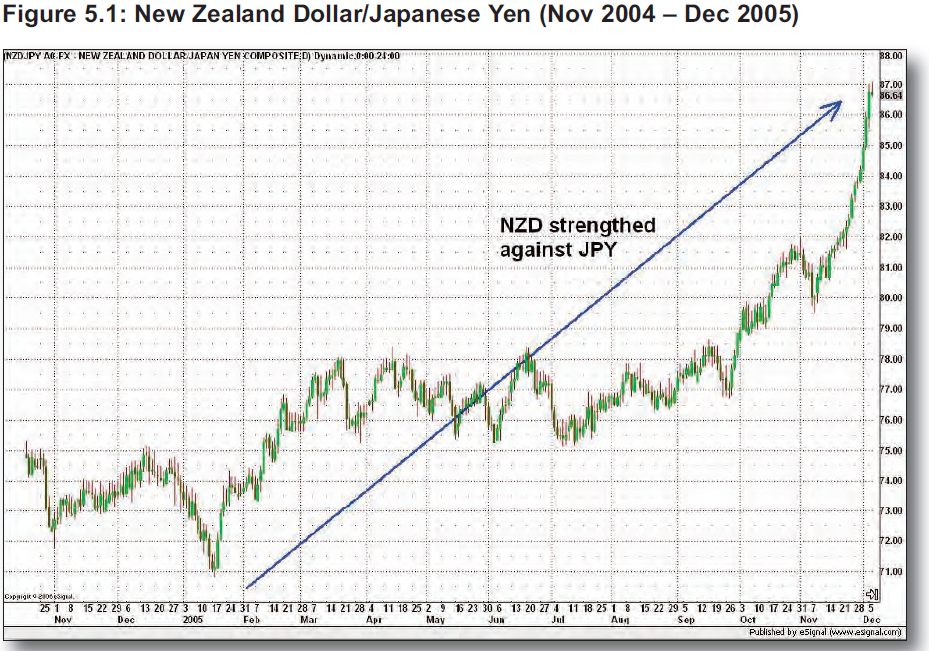

forex market as currencies are highly sensitive, and thus react very fast to changing

economic conditions of countries or regions, changing interest rates and political

happenings around the world. Sometimes central banks of countries attempt to

intervene in the forex market if the policy-makers feel that their country’s currency

is too strong or too weak for their own good. All these factors lead to high volatility

of currency prices, which can be taken advantage of by traders who speculate on

.the direction and magnitude of the current and future price move

,quite volatile in nature, most major currencies generally move less than 1% daily

which is much lower than that of active stocks, which can easily move between5 10%per day. For a rough guide of currency pairs and their relative volatility, refer

.to Figure 1.1 under “Warming Up” in the later part of this chapter

speculators to trade, in addition to the usual staple of stocks and futures

game –